Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Program

Relevance of Affordable Home Insurance Coverage

Safeguarding budget friendly home insurance is important for safeguarding one's building and monetary wellness. Home insurance coverage supplies security versus numerous risks such as fire, burglary, natural calamities, and personal responsibility. By having an extensive insurance policy plan in position, property owners can relax ensured that their most significant financial investment is protected in case of unexpected conditions.

Economical home insurance policy not only supplies monetary protection yet likewise supplies peace of mind (San Diego Home Insurance). When faced with increasing building values and construction prices, having a cost-effective insurance coverage policy makes certain that property owners can easily reconstruct or repair their homes without encountering significant financial worries

Additionally, inexpensive home insurance coverage can also cover individual items within the home, offering reimbursement for things damaged or stolen. This insurance coverage expands past the physical framework of your home, protecting the materials that make a home a home.

Coverage Options and Boundaries

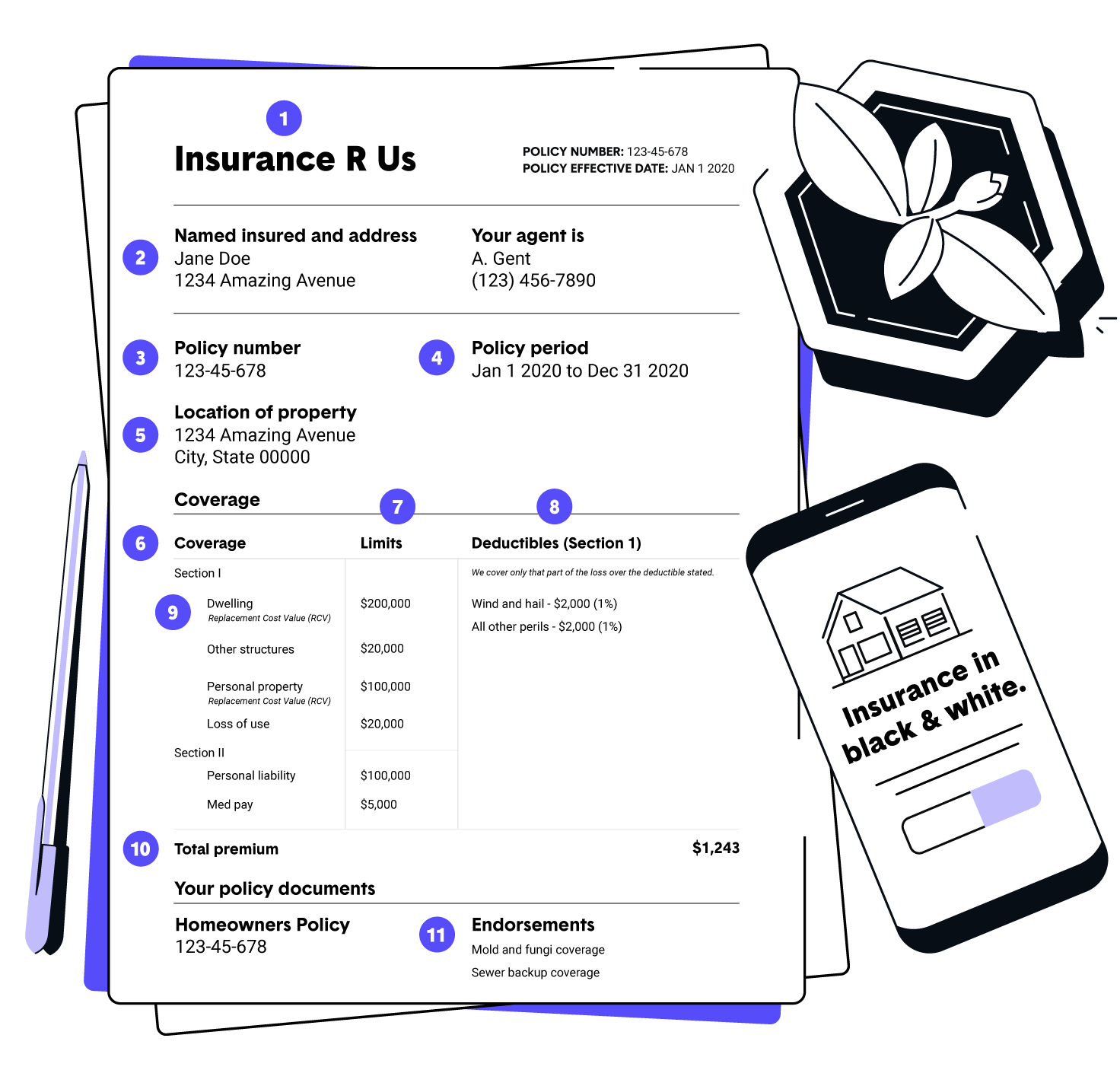

When it concerns protection limits, it's essential to understand the maximum amount your policy will pay out for each and every kind of insurance coverage. These limits can differ depending on the policy and insurance company, so it's important to evaluate them meticulously to ensure you have her response appropriate protection for your home and possessions. By recognizing the coverage alternatives and limitations of your home insurance coverage plan, you can make enlightened decisions to secure your home and liked ones successfully.

Elements Impacting Insurance Coverage Costs

A number of variables considerably influence the costs of home insurance coverage. The area of your home plays an essential function in figuring out the insurance premium. Homes in locations prone to natural calamities or with high criminal offense prices normally have greater insurance coverage costs due to raised threats. The age and condition of find more your home are also aspects that insurance companies take into consideration. Older homes or residential properties in bad problem might be a lot more expensive to insure as they are more susceptible to damage.

In addition, the sort of insurance coverage you select straight influences the expense of your insurance plan. Choosing additional coverage alternatives such as flood insurance or quake insurance coverage will enhance your premium. Selecting higher coverage restrictions will certainly result in higher costs. Your deductible quantity can also impact your insurance policy expenses. A higher insurance deductible typically indicates lower costs, but you will need to pay more expense in case of a case.

Additionally, your credit history, claims history, and the insurance provider you choose can all affect the cost of your home insurance coverage. By thinking about these variables, you can make enlightened choices to help handle your insurance costs effectively.

Comparing Suppliers and quotes

In addition to contrasting quotes, it is critical to examine the reputation and financial stability of the insurance policy companies. Search for consumer reviews, rankings from independent agencies, and any background of grievances or governing actions. A trustworthy insurance policy copyright need to have an excellent record of quickly processing claims and providing excellent client service.

In addition, think about the particular coverage attributes provided by each provider. Some insurance companies might provide fringe benefits such as identity burglary security, tools breakdown coverage, or coverage for high-value items. By meticulously contrasting quotes and companies, you can make an educated decision and select the home insurance policy strategy that best satisfies your needs.

Tips for Conserving on Home Insurance Coverage

After completely contrasting quotes and carriers to discover the most suitable insurance coverage for your demands and budget, it is sensible to check out efficient techniques for conserving on home insurance. Numerous insurance business supply price cuts if you purchase several plans from them, such as incorporating your home and car insurance policy. Routinely reviewing and upgrading your plan to show any adjustments in your home or situations can ensure you are not paying for coverage you no longer demand, assisting you conserve cash on your home insurance costs.

Conclusion

To conclude, safeguarding your home and enjoyed ones with budget-friendly home insurance is crucial. Recognizing insurance coverage alternatives, limitations, and aspects affecting insurance prices can assist you make notified choices. By contrasting quotes and companies, you can discover the finest plan that fits your needs and budget. Carrying out suggestions for reducing home insurance can likewise assist you protect the needed protection for your home without damaging the financial institution.

By unraveling the ins and outs of home insurance plans and discovering sensible approaches for safeguarding affordable protection, you can ensure that your home and loved ones are well-protected.

Home insurance plans generally supply several coverage choices to safeguard your home and items - San Diego Home Insurance. By recognizing the protection choices and limits of your home insurance plan, you can make educated decisions to protect your home and liked ones effectively

On a regular basis assessing and upgrading your policy to mirror any type of adjustments in her explanation your home or situations can ensure you are not paying for insurance coverage you no longer need, assisting you conserve cash on your home insurance policy premiums.

In conclusion, securing your home and enjoyed ones with cost effective home insurance policy is crucial.